Business Insurance in and around Cookeville

Cookeville! Look no further for small business insurance.

Insure your business, intentionally

- Cookeville

- Monterey

- Baxter

- Putnam County

- Sparta

- White County

- Rickman

- Overton County

- Jackson County

- Dekalb County

- Smith County

- Cumberland County

- Jamestown

- Fentress County

- Lynchburg

- Moore County

- Crossville

- Smithville

- Center Hill Lake

- Dale Hollow Lake

- Cordell Hull Lake

- Algood

Help Protect Your Business With State Farm.

Whether you own a a pet groomer, a toy store, or a stained glass shop, State Farm has small business protection that can help. That way, amid all the different options and moving pieces, you can focus on your next steps.

Cookeville! Look no further for small business insurance.

Insure your business, intentionally

Protect Your Future With State Farm

When one is as committed to their small business as you are, it makes sense to want to make sure all systems are a go. That's why State Farm has coverage options for commercial auto, worker’s compensation, business owners policies, and more.

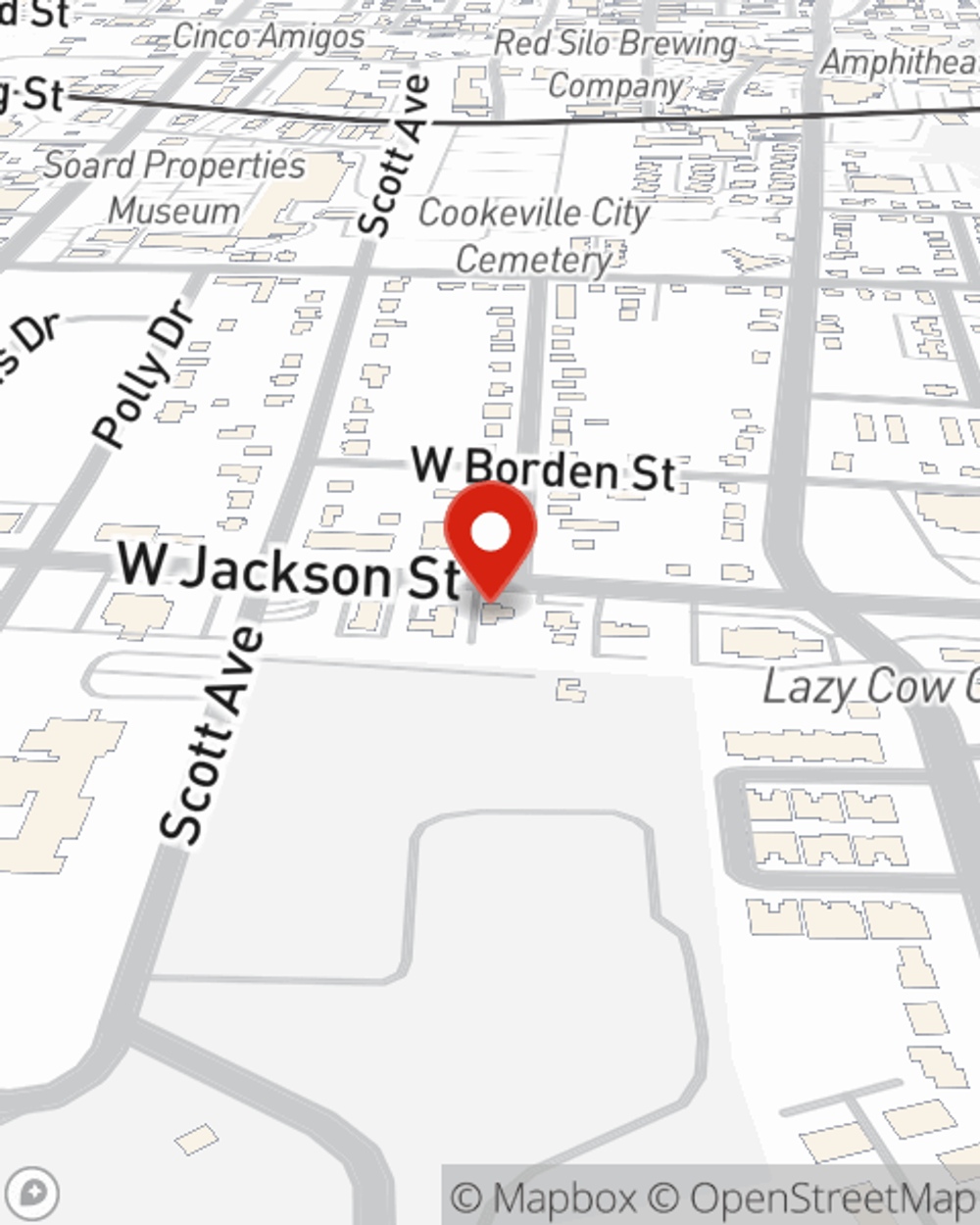

The right coverages can help keep your business safe. Consider visiting State Farm agent Elwood Ervin's office today to discover your options and get started!

Simple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Elwood Ervin

State Farm® Insurance AgentSimple Insights®

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.